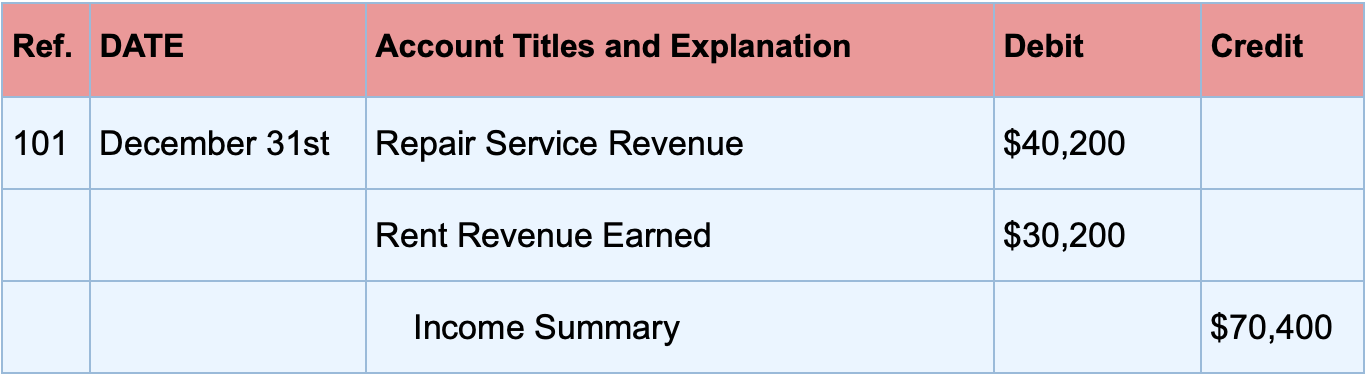

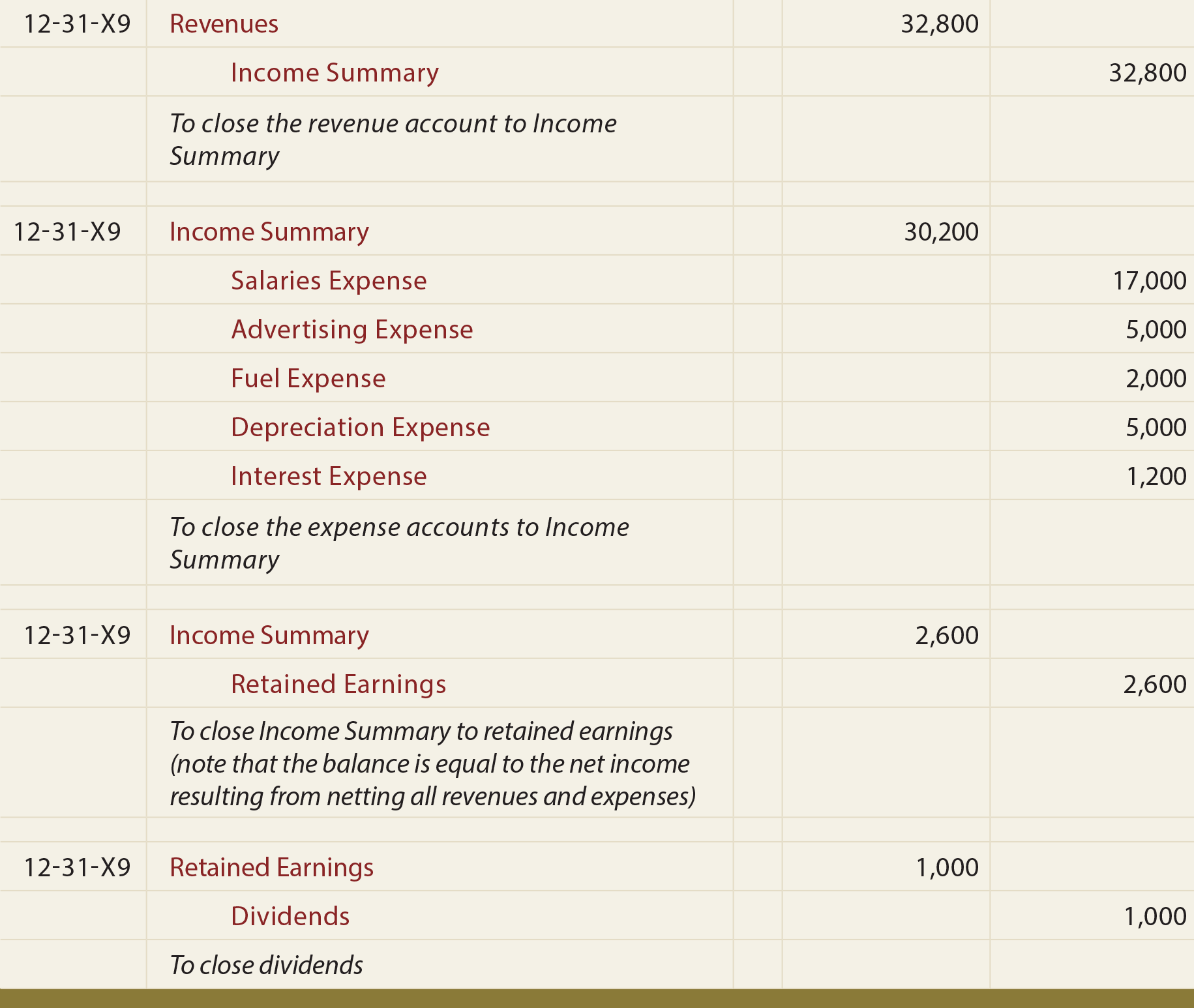

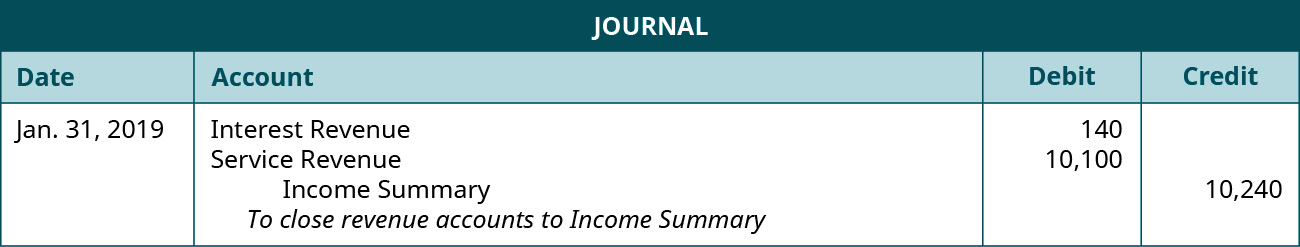

Closing Revenue Accounts Journal Entry

However there is no such difference in journal vouchers. Thus to check if the debit or credit amounts you record in the ledger are accurate you need to prepare.

Closing Entries Definition Types And Examples

100000- was deposited in SB BANK Fixed Deposit AC Dr 100000 To SB BankAC 100000 Being fixed deposit was done in SB Rules for passing Journal entry Debit Fixed deposits are treated as non-current asset or current asset is depended on maturity period if maturity period is less than one year from the date of.

. Verify that all entries that should have been entered actually were entered. Journal entries can be simple ie one debit and one credit or compound ie one or more debits andor more credits. A reversing entry is a journal entry made in an accounting period which reverses selected entries made in the immediately preceding period.

Adjusting Journal Entry. Journal entry is recorded in the journal ie the primary books of accounts while vouchers are the record documents kept as evidence for the journal entry. Below are the examples of Sales Return Journal Entry Example 1.

There will be no entry for the amount of trade discount granted by the manufacturer to a wholesaler in the books of accounts of both parties. It made sales for 50000000 in Aug 2019 and it sold 60 on a cash basis and the rest was sold on. Double-entry bookkeeping is an accounting system that records each of your business transactions into at least two different accounts.

Calculate the balance the difference between the total debits and total. Balancing off Accounts Process. Journal Entry for Fixed Deposit Fixed deposit Rs.

In this journal entry the purchase of 5000 does not add to the inventory balance but it will be used in the cost of goods sold calculation. At the end of the accounting period the ledger account needs to be balanced off in four stages as follows. Hence unlike in the perpetual system the company cannot check how much balances the inventory has immediately after adding the.

Review and post revenue recognition from schedules. In addition to this Robert Johnson Pvt Ltd made purchases worth 6000000 during the year. XYZ is operating in retail goods and when it sells its goods it is mentioned in its invoice that goods can be returned within 30 days.

Close sub-ledgers if any. Robert Johnson Pvt Ltd needs to determine its accounts payable turnover ratio for 2019 It had an opening accounts payable balance of 500000 and a closing accounts payable balance of 650000. Post deferrals accruals and reversals.

Total both the debit and credit sides of the ledger account. Accrued revenue which may. Post closing entries in the general journal.

Post depreciation amortization and any other revenue or expenses from other modules. In the example quoted above the manufacturer as well as the wholesaler will record the salepurchase in their books of accounts by 680000 discounted amount instead of 800000 gross amount. The inventory balances will be based only on the physical count of inventory at the end of the period.

That is each of your business transactions has an equal and opposite effect in a minimum of two different accounts. Accrued revenue is an asset class for goods or services that have been sold or completed but the associated revenue that has not yet been billed to the customer. The balance at the end of an accounting period is known as the ending balance or closing balance.

An adjusting journal entry is an entry in financial reporting that occurs at the end of a reporting period to record any unrecognized income or expenses for the period. It is commonly used in situations when either revenue or expenses were accrued in the preceding period and the accountant does not want the accruals. Examples of Sales Return Journal Entry.

The reversing entry typically occurs at the beginning of an accounting period.

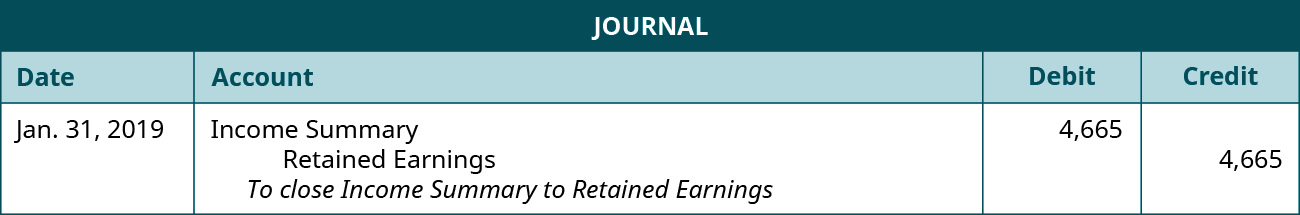

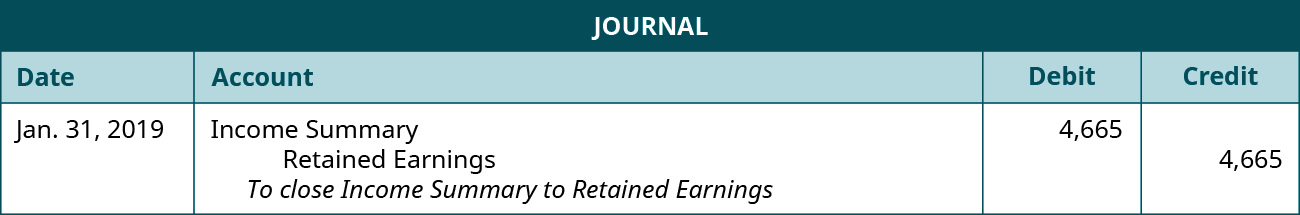

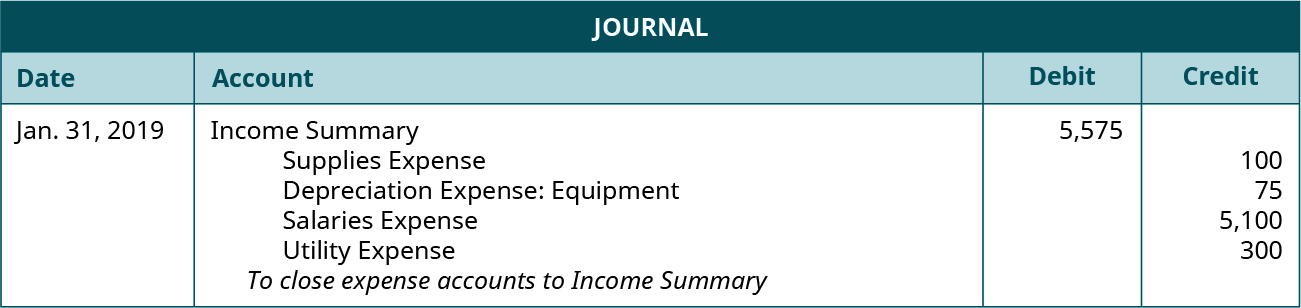

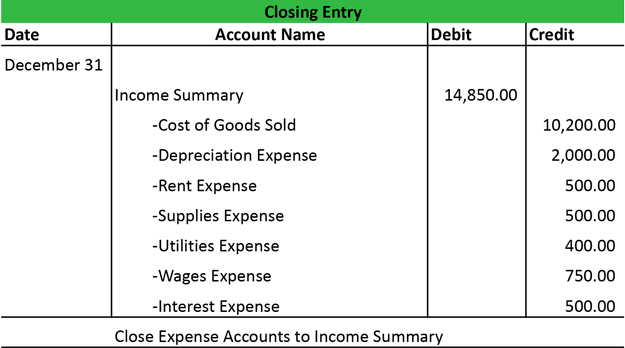

1 15 Closing Entries Financial And Managerial Accounting

1 15 Closing Entries Financial And Managerial Accounting

You Tube Video Governmental Accounting Understanding J E S For Budget Revenues Expenses Budgeting Cpa Exam Accounting

Closing Revenue Expense And Dividend Accounts Principlesofaccounting Com

Comments

Post a Comment